V-Test: China’s KYEC

Triple Hits of Mix, Volume & Pricing

I first came across V-TEST while following developments in the domestic semiconductor testing sector. Upstream domestic equipment manufacturers like Changchuan Technologies reported strong results recently, with the stock up roughly 50% in a week. At the same time, Japanese testing equipment manufacturers such as Advantest are reportedly receiving substantial orders. This drew my attention to the massive capacity expansion happening in domestic testing facilities.

Mix:

The timing makes sense given the current breakthrough in Chinese chip technology. Previously, the focus was on SoCs and power semiconductors like SiC for EVs. Now, the demand is shifting to higher-value and more complex logic chips, including GPUs from Ascend and ASICs for companies like Alibaba. These advanced chips require domestic testing because they involve sensitive intellectual property that cannot be entrusted to foreign partners, particularly for advanced nodes. This surge in demand points to a strong business outlook for domestic testing providers like V-TEST. The company focuses on testing AI compute chips (CPU/GPU/AI), advanced packaging (Chiplet/SiP), and automotive-grade chips. In 2025, the proportion of high-end business is expected to rise above 70%. Orders from leading clients such as NVIDIA and Alibaba continue to materialize, and revenue from automotive-grade testing is expected to increase from 13.5% in 2024 to over 20%. There had been rumors of V-TEST helping Huawei to Test their Ascend chips and Changxin for their HBM, but at this stage it’s yet to be verified. I believe it’s totally plausible since there are limited number of third party advanced node testing service providers that are based in mainland China.

Volume:

Looking at comparable peers, KYEC’s monthly testing volumes for NVIDIA chips are showing double-digit growth, signaling accelerating demand. Chip demand for Accelerated Compute is driving a supercycle with no end in sight., which could mean that due to constrained capacity and strong demand, the testing business is being revalued from a cyclical business to a growth business.

V-TEST stands out as one of the few listed testing service providers that is profitable, has a strong track record, and has upcoming capacity to meet this new demand. Reported utilization rates have steadily increased from the low 80s to around 95%, with potential for further expansion given strong orders (running double shifts, etc). Testing is an asset heavy business much like the Fabs. It can be incredibly profitable when it’s running 24/7, but if the utilization rate falls, profits turned to a loss very quickly. We believe the China’s domestic semiconductor has achieved a breakthrough or exit velocity from the sanctions and other constraints. In the upcoming years we will see massive commercialization or even exports of Chinese chips, benefitting V-Test. In the last cycle, V-TEST achieved operating margins of roughly 27%, a level we find attainable compared with peers like KYEC, whose current margins are currently standing at 27%. This could represent a 1000bps operating margin improvement opportunity.

Price:

There is also a pricing component in this story, since the capacity is already constrained before the big launches like Ascend 910C and Alibaba’s ASIC chips, customers with deep pockets would pay more to get their chips tested first. It already happened for KYEC as rush orders from Broadcom and Nvidia comes through, I believe similar is going to happen to V-Test.

Factory image of V-TEST

Competitive Advantages: Domestication & Tech Know-how with advanced equipment

V-TEST’s technology barriers are substantial. The company is one of the few domestic firms capable of testing 7nm–14nm advanced process chips across 6–12 inch wafer sizes, covering CPU, GPU, FPGA, and other high-performance chips. V-TEST owns industry-leading three-temperature probe stations and environmental test equipment capable of automotive-grade AEC-Q100 testing (-55°C to 150°C) with ±0.5°C precision. The company also supports complex packaging solutions including Chiplet, SiP, SoC, and has developed testing for HBM3E memory chips, filling domestic gaps. V-TEST’s R&D team comprises industry veterans with over 10 years of experience on average from top global semiconductor and packaging companies, led by founder Pian Wensheng, who has senior management experience in Motorola, ASE, and JCET. The company maintains long-term incentive schemes and multi-phase restricted stock plans to retain talent.

V-TEST’s client base provides a strong competitive moat. Certification cycles for high-end customers are lengthy—for example, automotive clients require ISO 26262 functional safety certification over 6–12 months—and V-TEST has achieved early certification with leading clients such as BYD and Horizon Robotics. The company has over 200 customers, including SMIC, Unisoc, Aojie, Huawei, and Cambricon, with the top five clients maintaining relationships for over five years, ensuring stable orders and high stickiness.

V-TEST’s strategic layout includes four major test centers in Wuxi, Nanjing, Shanghai, and Shenzhen, covering high-performance and high-reliability chip testing for AI, cloud computing, IoT, 5G, EV, autonomous driving, and high-end consumer electronics. Shanghai, Wuxi, and Nanjing form a coordinated “1-hour service circle” in the Yangtze River Delta, enabling rapid response and supply chain efficiency. The company continues to expand nationally, with new facilities planned in Chengdu and other regions to cover the southwest market.

Orders from a diverse set of domestic customers, most of them are listed, innovators within their perspective fields.

Financials

The management has experience from industry leaders like KYEC and other advanced nodes packaging companies, and they are actively hiring R&D staff from those companies to attract talent and learn from the best. V-TEST invests heavily in R&D and capital expenditures to maintain technological leadership and scale. In 2024, R&D spending was 142 million RMB (+37.16% YoY), with H1 2025 reaching 82.13 million RMB (+27.34% YoY), focusing on 5.5G RF wafer testing, HBM3E, 3D Chiplet, and automotive SoC testing. High-end equipment investments in Wuxi, Nanjing, and other bases exceed 1 billion RMB annually, including Advantest V93000 and Teradyne UltraFlex Plus, ensuring industry-leading capacity that is difficult for smaller firms to replicate. Scale advantages are evident: in 2024, wafer tests reached 1.31 million units (+31.25%) and chip tests 2.983 billion units (+92.27%), with utilization rates of 85–90%, projected to reach 95–100% in H2 2025.

Operational performance reflects strong growth. In 2024, revenue was 1.077 billion RMB with net profit of 128 million RMB (net margin 11.88%). Q1 2025 revenue reached 285 million RMB, net profit 25.92 million RMB, and H1 2025 revenue was 634 million RMB with net profit 101 million RMB (net margin 15.93%), representing a 47.53% increase in revenue and 831% increase in net profit over H1 2024. Q2 2025 alone achieved record revenue of 349 million RMB and net profit 75.08 million RMB (21.51% margin). Q3 2025 is expected to see further substantial growth driven by the ramp-up of Wuxi Phase III high-end capacity, which will increase production by 30–50% over Q2 and profits by 40–60%.

Risk: Geopolitical Risk on Advanced Node Equipment Ban

The only concern I have is the geopolitical risk because testing equipment for advanced nodes are still dominated by Japanese and American companies. If trade tension escalates, they might restrict exports of such equipment to China.

However, domestic equipment manufacturers like Changchuan and Huafeng have made significant progress. And the expansion projects for the two most recent factories are almost complete at 97%, which means the equipments already arrived. This should pave the way for at least two years, and I assume by then domestic equipment manufacturers would have made more progress on the advanced nodes.

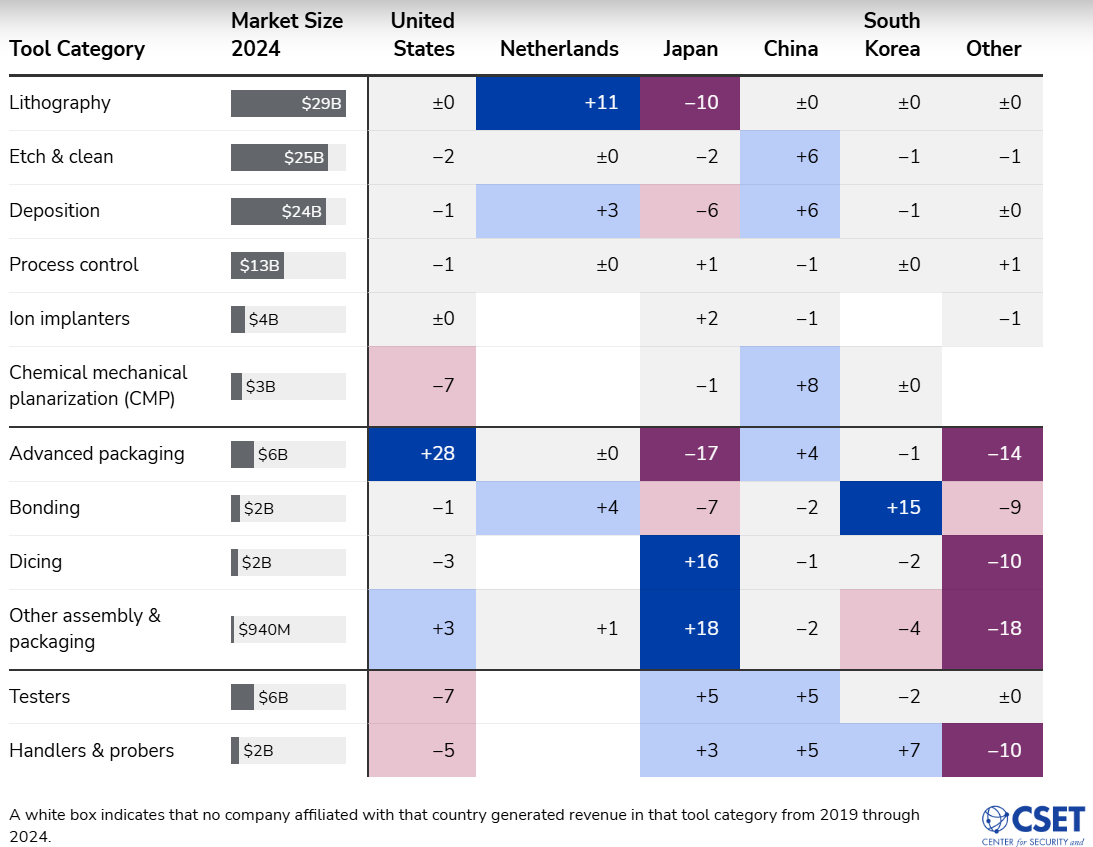

China has made progress in test tools, such as linear and discrete test tools, burn-in test tools, and system-on-a-chip (SoC) test tools, demonstrating rapidly advancing domestic capabilities in segments where technical barriers are relatively lower compared with fabrication equipment.

China gained 24 pp in linear and discrete test tools, 9 pp in burn-in test tools, and 5 pp in SoC tools. China is the only country that gained market share in linear and discrete test tools and has solidified its position as the leading supplier with 69% of the market, followed by the United States, which has lost 10 pp and now accounts for 16% of the market. China entered the burn-in test tools segment in 2021 with just under 2% of the market and now accounts for 9% of the market. In the SoC test tools segment, China entered the market in 2020 and has claimed 5% of the market so far. Overall in test tools, Hangzhou Changchuan Technology and AccoTEST are China’s leading suppliers.