Light Chasers - Everbright

During the National Day holiday, I conducted a systematic review of the optical module industry chain and formed several preliminary views that may serve as a starting point for further discussion.

Applications of Lasers

The optical module industry originated from telecommunications, where modules were mainly used for transmitting optical signals between base stations and core networks. These early modules emphasized long-distance transmission, high reliability, and environmental adaptability. They connect base stations, core networks, and transport equipment, characterized by long transmission distances (10–80 km) and high reliability. Typical data rates include 10G, 25G, and 50G, and they are widely applied in mobile communication, fiber-to-the-home, and 5G fronthaul, midhaul, and backhaul networks.

Beyond communications, photonics technologies — especially semiconductor and fiber lasers — have broad industrial applications, from high-precision manufacturing such as PCB laser cutting, micromachining, and welding to heavy-duty, high-temperature cutting in steel and automotive production. Newer defense and security use cases are also emerging, including directed-energy systems and anti-drone solutions that use laser beams to disable or disrupt hostile drones.

With the rise of cloud computing and data centers, optical modules have evolved from serving telecom networks to supporting high-speed interconnects inside data centers. Transmission speeds have increased from 10G and 25G to 400G, 800G, and even 1.6T.

The rapid advancement in light module technology driven by data center demand created a double tap on both volume and price. 400G cost 150 dollars, 800G 300 dollars, 1.6T is 1500 dollars. The value is growing exponentially. And it still provides much value to hyperscalers because it improves the networking speed, allowing the GPU to commute faster and unleash their full computing power.

China’s Rise to Dominance in Transceivers

For much of the past decade, the global optical communications industry was dominated by American and Japanese firms. Upstream key components such as lasers, detectors, AWGs, and driver chips were controlled by companies like Lumentum, II-VI (now Coherent), Broadcom, and NTT. Chinese companies were mostly engaged in midstream and downstream module assembly and packaging. However, this landscape is now changing.

Chinese producers took 7 out of top 10 spots for transceiver suppliers. Their market share is expected to further increase as their capacity scales, taking up more share in more advanced nodes like 1.6T. However, domestic supply of core components like ROSA & TOSA accounts for a much smaller share (5-20%). This is the next step for domestication.

Chinese manufacturers have leveraged rapid execution, cost control, and strong automation capabilities to gain global competitiveness. Representative players include InnoLight, Eoptolink, Accelink, and Cambridge Industries. Meanwhile, progress in domestic component localization has been substantial. Passive components such as AWGs, isolators, and PLCs now have the highest localization rate, with suppliers like TFC fully integrated into major supply chains. In lasers and detectors, companies such as Everbright, Accelink, and Brocade have achieved large-scale shipments of DFB and PIN devices, while EML lasers are entering small-scale production. Structural and packaging components are almost fully localized, with TFC and Ruiyi Optoelectronics serving as core suppliers for top module makers. The main gap remains in chip components such as DSPs, which are still dominated by Broadcom and Marvell, though some domestic firms have begun small-scale supply of drivers and TIAs. Overall, domestic components have achieved mainstream application in low- to mid-speed telecom modules and are now steadily penetrating the high-speed AI data center segment.

On CPO: A Plus for the Component makers

CPO is the clear future for optic transceivers, it might have a negative impact on light module manufacturers but it benefits component producers like everbright.

CPO (Co-Packaged Optics) represents the next major step in optical communication technology. Traditional pluggable optical modules have long dominated telecom and data center markets thanks to their maturity and easy maintenance. However, as data center bandwidth requirements rise in the 800G and 1.6T era, electrical interconnects face growing challenges in loss, power, and heat dissipation. CPO offers a system-level solution by integrating optical engines and switch chips within the same package, shortening electrical interconnects and significantly reducing power consumption and latency.

That said, it is still early for CPO to replace traditional pluggable modules. Optical modules continue to evolve rapidly from 400G to 1.6T and beyond, and market demand remains strong. For module makers, CPO presents both opportunity and risk: in the long run, tighter integration with ASICs and SerDes may reduce their autonomy and pricing power, as critical design decisions shift upstream to chip or system vendors. In the short term, those that master CPO packaging could secure access to high-end customers, though technical barriers and capital requirements are high.

For optical chip and device makers (components), CPO is broadly positive, as it accelerates demand for customized high-performance components and strengthens relationships with data center clients. For the industry as a whole, CPO represents a long-term positive trajectory toward higher bandwidth and lower latency, enabling the next generation of AI computing and cloud infrastructure.

Learning from History: Development Path for Lumentum & Coherent

The experience of leading U.S. optoelectronics companies provides a useful comparison. Lumentum, spun out from JDSU in 2015, built its foundation on InP platforms and laser technology. It developed high-speed EML and DFB lasers for data centers and has entered the AI data center supply chain, collaborating with NVIDIA on optical switching chips and modules. Coherent (formerly II-VI) began with ZnSe and ZnS optics for CO₂ lasers and grew through industrial laser processing. Its acquisition of Finisar gave it full vertical integration from materials and chips to modules, and today it covers VCSEL, EML, and CW lasers for 400G/800G/1.6T transceivers while actively developing CPO. Both companies share key traits: they started from industrial lasers, accumulated deep material and process expertise, entered data center communications, and strengthened their positions through vertical integration and acquisitions.

We previously mentioned that the history of applications for optical modules/transceivers evolving from industrial and telecom to the most recent data centers. Despite their differences, the foundational layer of transceiver technologies are interconnected, and US companies have successfully demonstrated their ability to apply their know how from one industry to the next. We think Everbright is the best positioned to make the transition, and replicate western peers’ success.

Everbright - Light Chaser

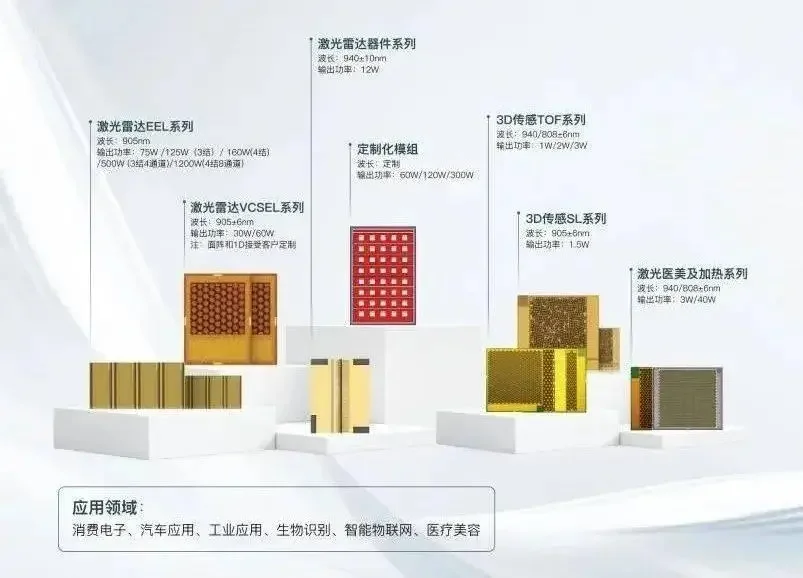

Everbright follows a similar but localized path. Founded in 2012, it adopted an IDM model from the start and achieved breakthroughs in high-power semiconductor laser chips. Its business spans industrial pump lasers, 3D-sensing VCSELs, LiDAR, and high-speed optical communication chips. The company built a leading 6-inch compound semiconductor fab and gradually expanded into optical communications, introducing 10G EML, 100mW CW DFB, and 50G PAM4 VCSEL products serving 10G–800G markets.

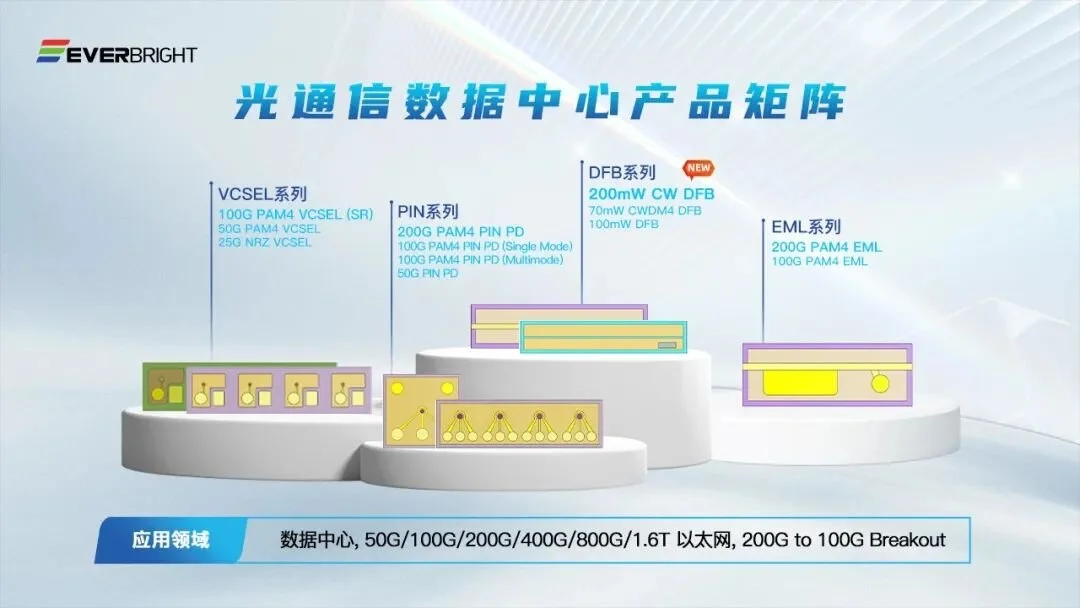

Everbright released their new product lineup in the Shenzhen Light Expo on September. Products like 200G EML and 200mW CW DFB are leading nodes in the industry, demonstrating their leadership.

At the 2025 Shenzhen Optical Expo, Everbright unveiled a 200mW uncooled CW DFB chip designed for 800G/1.6T silicon photonic modules and CPO external light sources, demonstrating strong high-temperature performance and energy efficiency. It has received investment from CAS Capital, SDIC, and Huawei’s Hubble, with Hubble’s involvement paving the way for collaboration with Huawei and other system integrators in CPO projects.

In comparison with U.S. peers, Everbright has built similar strengths: accumulation of InP/GaAs/GaN process expertise through its industrial laser base, IDM manufacturing integration enabling entry into high-speed communications, vertical expansion into AI and cloud-oriented CPO solutions, and close partnerships within the Huawei ecosystem (Huawei owns close to 7% of the float and has long partnerships with everbright tracing to the telecom era). Its strategy targets high-speed interconnect markets such as 400G, 800G, and 1.6T, extending industrial laser know-how into data center applications.

From an investment perspective, Everbright’s product portfolio is among the most comprehensive, covering VCSEL, CW DFB, EML, and PIN devices — most already verified or in production — yet its current valuation remains modest, leaving significant upside potential. The company’s business model reflects a “solid base with scalable growth” structure.

Its industrial high-power laser business forms the foundation, providing stable cash flow, especially as demand for military laser weapons such as anti-drone systems rises following a 2023–2024 downturn. Meanwhile, VCSEL and LiDAR products are on the verge of scaling up as L3 autonomous driving policies take effect and automakers such as BYD adopt LiDAR systems.

A significant revenue inflection is expected in 2026, driven by dual growth engines in LiDAR and optical modules. At this stage, the focus should be on technology progress and production ramp-up rather than short-term profitability. If verification and volume expansion continue smoothly, next year’s results could see substantial improvement.

For reference, Yuanjie Technology, a comparable company, currently has a market capitalization of about RMB 36 billion, while Everbright’s is around 12 billion, implying meaningful revaluation potential.

Analyst commentary further supports this view. Yuanjie has achieved mass production of 70mW CW sources and reported over RMB 100 million in optical chip revenue in the first half of 2025. Its 100G PAM4 EML and 100mW CW chips have passed client validation, while 200G EML is under testing. Shijia’s active optical chip business remains small and focused on telecom DFBs. Everbright’s active optical chip revenue reached roughly RMB 25 million in the first half of 2025, an eightfold year-on-year increase, driven by 100G PAM4 EML mass production. It is also delivering 200G EML samples for validation, while its 100G VCSEL, 100mW CW DFB, and 70mW CWDM4 DFB chips have reached mass production levels, along with PIN products. Despite having the broadest optical chip lineup, Everbright remains the smallest by market capitalization.

Its industrial high-power laser business remains the company’s core foundation, now rebounding as military laser weapon demand rises. This segment ensures stable cash generation while the VCSEL and automotive LiDAR businesses expand rapidly, driven by policy support and major OEM adoption. Together, they form a structure of steady base and strong incremental growth, positioning the company for long-term expansion in both optoelectronics and optical communications. The expected revenue acceleration in 2026 will likely come from the dual engines of LiDAR and optical modules. For now, investors should watch technological milestones and production scale-up, as profits will follow. The outlook for the next year appears highly promising.

Recommendation:

We recommend building an initial position first then closely track the business status on its datacenter related products; whether they obtained new customers, improved the production wafer/chip yield, or new technology breakthrough.