Harmony Auto - Dealership Turnaround

I started paying attention to Harmony Auto (03836 HK). Back then it was only around HK$0.60 a share and extremely illiquid, with barely HK$100k of daily turnover—basically a penny stock. But because I’m a shareholder of BYD (SZ002594) and optimistic about its overseas push, I was drawn to Harmony Auto’s deep partnership with BYD abroad. Wang Chuanfu and Stella Li have repeatedly appeared at Harmony Auto showrooms, which gave me confidence.

BYD needs a trustworthy partner for its overseas expansion—someone to handle local Chinese-community business and also to supervise local agents, acting as a “catfish” to keep pressure on them. Harmony, meanwhile, needs to transition from ICE to NEVs. The two sides are therefore a natural fit.

What I mainly want to do here is run some numbers on Harmony Auto to see when it might break even. Since there’s little public research available, I hope this can serve as a starting point and a reference for new shareholders.

I think several variables are key to assessing Harmony Auto’s profitability:

Number of overseas showrooms

Average monthly sales per showroom

BYD’s per-vehicle selling price overseas

Harmony Auto’s net profit as a percentage of vehicle price

Equity structure and the domestic situation

1. Showroom count:

Harmony just announced 100 overseas BYD showrooms versus 53 last year (including 13 in Hong Kong). So it added 47 showrooms between January and July—about six to seven per month. Over the remaining five months I think it could add another 20–30, reaching 120–130 showrooms by year-end.

Looking ahead, as BYD’s overseas sales rapidly scale, I think BYD could surpass 4 million units by 2030—more than triple in five years. If Harmony keeps pace, it will ride a very fast-growing track.

2. Average monthly sales per showroom:

I’ve triangulated this from various sources. If anyone has data, please comment. My estimate is 50 units per month:

Hong Kong sells about 12,000 units a year across 13 showrooms—roughly 75 units per month each.

On LinkedIn the manager of Harmony Auto’s France store said they delivered 50+ cars in the first month.

An Australian top salesperson sold 300 cars over eight months alone.

ChatGPT and others say the average showroom sells 50+ cars a month; good stores do 150+.

Using 50 units/month, that’s 600 units/year per showroom. With 120 showrooms in a mature state, that’s over 70,000 BYDs sold—an aggressive assumption, but last year sales were only 7,000 because it was just starting to expand.

3. BYD’s per-vehicle selling price overseas:

I previously estimated around RMB250,000 per unit, though this will fluctuate as models like the Seagull are delivered.

4. Harmony’s net margin:

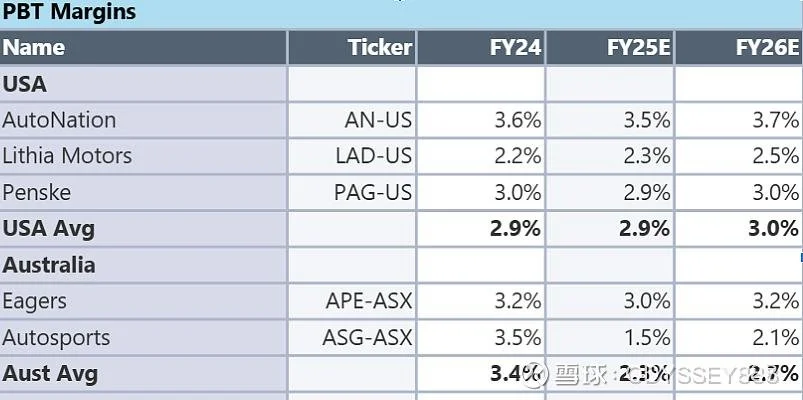

Looking at other overseas dealerships, margins are typically 1–3% of car price. Taking 1.5% as the midpoint, that’s ~RMB4,000 per car; at 2%, it’s ~RMB5,000.

Harmony Auto’s after-sales and used-car business isn’t yet operating at scale, so current per-car profits are low. But BYD may be subsidizing Harmony to encourage brand-building. If anyone has more details, please share.

When I was in Abu Dhabi I tried to ask local BYD dealer, Al Futtaim, to provide more detail on their unit economics but they are hesitant to share. Currently they are still making a loss due to heavy upfront marketing expense to promote the brand, and the utilization of the stores are lower, still ramping up. This will take one to two years, depending on BYD’s brand awareness and local ev penetration rate, but it’s a long term investment that once established can provide stable income streams from growing deliveries and aftermarket services.

5. Domestic situation and equity structure:

Not all overseas operations belong to the listed company. ICAR Group, for example, is 45% owned by the chairman because he funded the overseas build-out, so he gets a larger share of profits.

Domestically I assume break-even, as ICE car decline is severe but Harmony’s main domestic business is maintenance, which still benefits from a large installed base. But weaker-performing stores should be gradually exited to avoid drag.

2024 results: adjusted loss RMB146m, overseas loss RMB194m—meaning domestic is slightly profitable. I’m confident overseas will turn profitable soon. Wang wouldn’t let his partner lose money indefinitely.

Putting the numbers together:

120 stores × (50 cars/month / 600 cars/year) × RMB250,000 per car × 1.5–2% net margin (RMB4,000–5,000 per car) × 55% ICAR equity = ~RMB180m, or ~HK$200m net profit at 1.1 exchange rate.

Of course actual 2024 results should be lower because many stores are new and not yet mature. IR needs to communicate more to build investor confidence.

Valuation:

Traditional dealerships trade at low multiples (10–15x PE). But Harmony is expanding rapidly and BYD has many new models launching. Brand heat is rising, with BYD running ads across Europe, which should support further sales growth. Dealerships are asset-heavy—you need to rent stores and hire staff—but once they scale, profits ramp quickly, just like in China’s early private-car days.

If I assign 20x PE, that’s HK$4bn versus current market cap ~HK$1.8bn—implying potential to double. Technically the overhang is between HK$2–2.5, so my 2024 target price is at least HK$2. Mid-year results and stronger-than-expected BYD overseas sales would be catalysts.